The cryptocurrency market has come a long way over the past decade. The number of cryptocurrencies available on the market has been on the rise and subsequently, traders have identified opportunities to profit by trading the currencies similar to how people trade forex. Some concepts such as margin which are used in forex have also started to gain popularity in cryptocurrency trading.

What is margin in cryptocurrency trading?

Imagine a market scenario where you identify a market situation where you can predict the direction of the market with a high level of accuracy. This might be through the use of technical indicators or market knowledge. The picture that you have about $100 available to trade, but then you identify a tradable position that you can accurately predict, you can borrow an extra $100 from your broker. The borrowed additional sum is the margin.

Margin trading in cryptocurrency will allow you to earn significantly more than you would have made if you trade without leverage. It can be a useful tool for earning more money but it also raises the risk level.

Margin trading on Binance

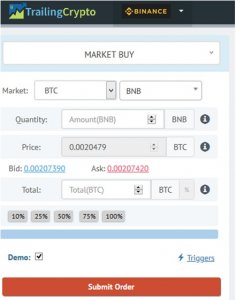

Binance is one of the few cryptocurrency exchanges that now offer margin trading on cryptocurrencies. There is a bit of a process to trading margin on the platform but it is relatively easy. You can visit the Binance website to create a margin trading account. Once you are done with the account creation process, you should make sure that you go through the KYC process and complete and you also need to active multi-factor authentication. These two are mandatory for a Binance trading account.

Once done with the above processes, go to the exchange tab on the top left section of the trading platform and this is where you will find the margin section. Once you read the risks disclaimer in the margin account agreement, you can go ahead and open the margin account.

Note that since you are using your margin account, you have to transfer funds from your exchange wallet to your margin account. You can then use those transferred funds in the form of your preferred cryptocurrency as collateral to borrow more. Note that the transfer is free and one can transfer to and from either side. Binance offers a fixed 3:1 ratio. This means that if you have 1 Bitcoin, you can borrow 2 extra Bitcoins.

Margin level

Binance shows a margin level which shows the trader their risk level based on the funds they borrowed and the funds that they hold as collateral. The risk level fluctuates based on market movements. A margin level below 1.3 prompts a margin call reminding the trader to increase his/her collateral by depositing more funds into their margin account or to lower the size of their loan by repaying the borrowed amount. When the margin level drops to 1.1, it triggers a liquidation. In other words, Binance will take action at the 1.1 level by selling your funds at market price so that it can repay your loan. Liquidation also attracts extra fees.

If you happen to make a profit, you can go to the repay section under the ‘borrow’ tab and this will allow you to repay the borrowed funds. Note that Binance is also available through the Growlonix crypto trading bot and so are many exchanges. To access Binance, on Growlonix, click on the pull-down menu next to the platform’s logo on the left side of the interface once you log in. This will pull down a menu containing multiple exchanges and you will find Binance among them. You will, however, have to set up APIs on in the settings menu.

Can we short sell crypto in Growlonix ?

Yes. Shorting is supported currently for bitmex. Binance shorting work is in progress.

Binance futures is available now for short sell in crypto

hi just wondering when binance margin will be going thanks

Binance Margin is live now.

wow! that’s great!Thanks for sharing

Does it works also for Isolated Margin ?

Yes it works for isolated margin. However toggling between cross and isolated mode is not supported you will have to toggle margin mode on exchange only. rest things are supported.