Welcome to Growlonix – The best trading platform for Binance Futures!

In this guide, we will learn how to trade Binance Futures. Growlonix provides a set of advanced trading strategies for Binance Futures with an easy-to-use platform and allows a seamless trading experience for traders.

Table of Contents

Binance Futures Review

Binance is one of the largest and the best crypto and Bitcoin trading platforms. Recently, Binance has released its perpetual futures trading platform, becoming the most popular trading platform by volume across the world.

Binance offers more than 140 crypto assets for trading including BTC, LTH, ETH, and Binance’s own token BNB. Since its launch, this platform has gained huge popularity among crypto traders for a number of reasons, such as:

- High market liquidity

- Lower transaction fees

- Excellent security standards

- Higher processing capabilities

The recently launched, futures trading platform – Binance Futures, allows traders to open both long and short positions for different cryptocurrencies with up to 125x leverage. Futures are also known as contracts that allow traders to use leverage. The Binance Futures trading allows traders to bet on the future price of any crypto asset. Currently, the most common kind of contract in crypto futures is Bitcoin futures.

Currently, Binance also provides trading bot services on the Binance Futures market. Grid trading bots is the Binance Futures trading bot which the traders are allowed to use on Binance.

Binance Futures trading integrates with the spot exchange, which means the traders can easily transfer profits from the futures account to their spot account, and vice-versa. The interface looks almost like the Binance spot trading interface, aside from a few extra functions for viewing open positions and controlling leverage.

The futures platform ensures a smooth user experience and makes futures trading even simple for the novice traders. All deposits are done via Binance platform from where the users can transfer USDT from their Binance spot USDT wallet to the Futures USDT wallet.

If you are about to trade crypto futures, Growlonix is the right platform that you should consider.

Futures Trading – How does it work?

Futures are the derivative products that allow traders to trade upon a projected future price of an asset. The best part about futures contracts is that it allows investors to bet on the price of cryptocurrencies without even owning them.

Whenever you look at the process of crypto futures trading on Binance, you may not understand how different it is. Futures contracts are not the same as spot trading as they are not operating with an underlying asset, but only with the price action.

Since, there is no real asset, Binance Futures contracts are very easy to handle. Aside from that, these contracts allow high leverage margin trading. It is a form of bet for the future movement of price in any crypto asset.

The futures market doesn’t allow users to directly buy or sell any crypto asset. Rather, the traders are trading a contract representation of those assets, and the actual trading of the crypto coin/asset will happen in the future when the contract is applied.

Crypto futures contracts offer protection against volatility and adverse price movements. With futures contracts, you can take advantage against adverse price movements and volatility. Regardless of whether the prices of the crypto coins will move up or down, futures contracts allows you to trade with ease.

If you believe that the price for Bitcoin (BTC) will have a price increase by the end of month, you would be interested in opening a long position by purchasing a futures contract on Bitcoin.

If you believe that the price of BTC will decrease, you may go short. Whenever the contract expires, the deal will close.

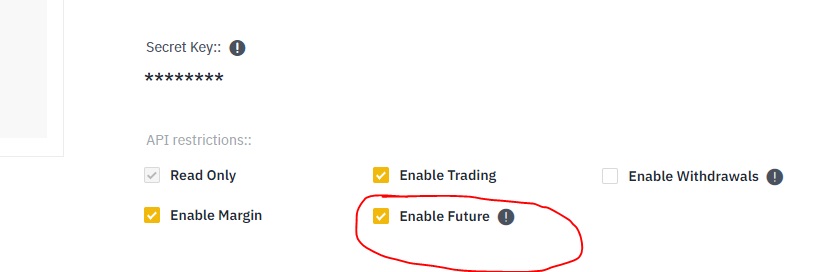

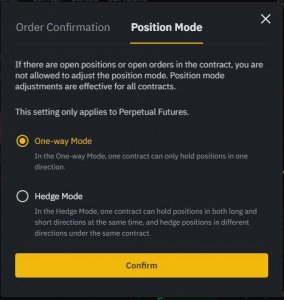

Your profit and loss will depend on the outcome of your prediction. For Binance Futures trading at Growlonix, make sure you have enabled the following settings:

- In the API settings, check if you have enabled futures trading permission for that API key.

- In the preferences, select position mode = One-way mode

Trade cryptocurrency with leverage on Binance Futures

While we all know that leveraged trading comes with inherent risks, traders who trade with leverage can earn good profits in a shorter period.

Let’s understand how it works:

If you buy BTC worth $100 and the exchange offers a leverage of 1:100, then you are trading with $10000, not $100. Any profit earned would be multiplied by 100.

While there are different ways to trade crypto with leverage, Binance Futures trading with leverage seems to be a game-changer.

Why should I trade on Binance Futures?

There are a few reasons why trades should consider Binance Futures trading:

- Opening a leveraged position

- Shortening Bitcoin and other cryptocurrencies

- Trade without owning funds because of leverage

Binance Futures also supports margin trading, spot wallet, and P2P trading.

To start trading on Binance Futures, the traders are required to open an account on Binance Futures.

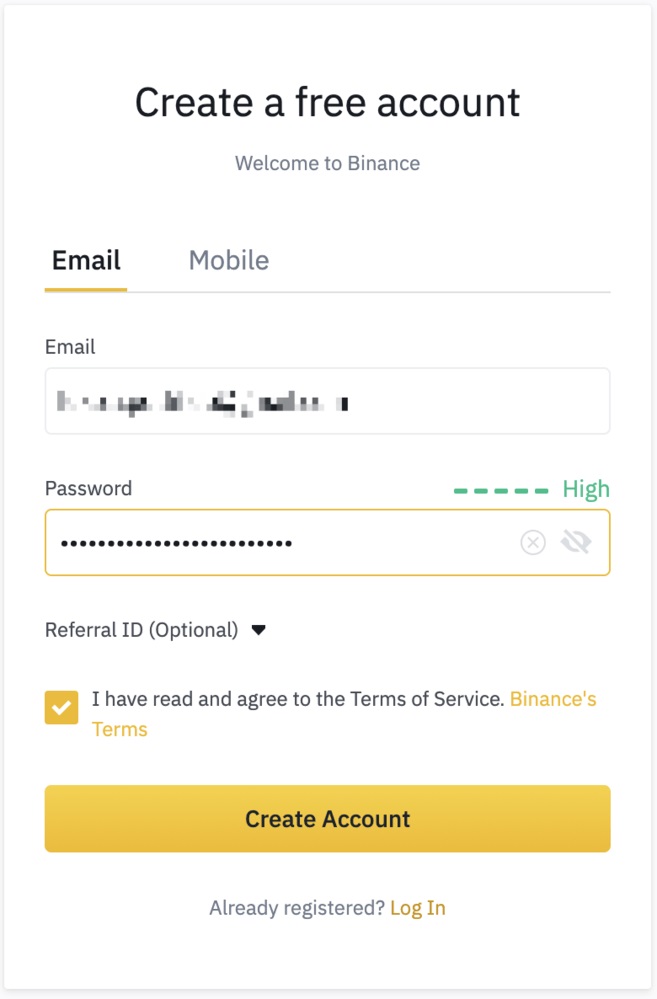

How do I create an account on Binance Futures?

Trading on Binance Futures platform is easier, but before opening an account on Futures, one must have a regular Binance account.

If you are new to Binance platform, install the Binance app on your system, or you may simply go to the official website of Binance, and follow the below steps:

- Click on the ‘Register’ tab in the top right corner of the web page.

- Enter your email ID and password

- Now click on the tab ‘Create Account’

- You will receive a verification code on your email soon. Now, follow the instructions here and complete your registration on Binance.

After opening your account on Binance, simply click on the Futures option on the top of your web page. Or you can also click on the Futures icon at the bottom of your home screen on the Binance app.

Trading Futures on Binance

Binance Futures offers a wide range of crypto futures tools to the traders, providing numerous ways to enter the market.

Traders can access different futures product lines in Binance Futures:

- USDT-margined Futures contracts

- Coin-margined Futures contracts

- Binance leveraged tokens

USDT and coin margined futures

Margin trading or leverage trading is a feature available on Binance Futures allowing its traders to leverage a certain amount by which the traders can multiply their position either long or short.

If a trader opens a trade with 100x leverage, both the potential profit and exposure will be multiplied by 100. As of now, Binance Future offers USDT-margined and coin-margined futures contracts. Let’s understand about them one by one:

With USDT-margined futures, the contracts are stabled in USDT (it’s the currency that holds same value as US dollars). Binance Futures offers perpetual futures contracts to trade. Unlike traditional futures contracts, they allow you to hold positions without any expiry date.

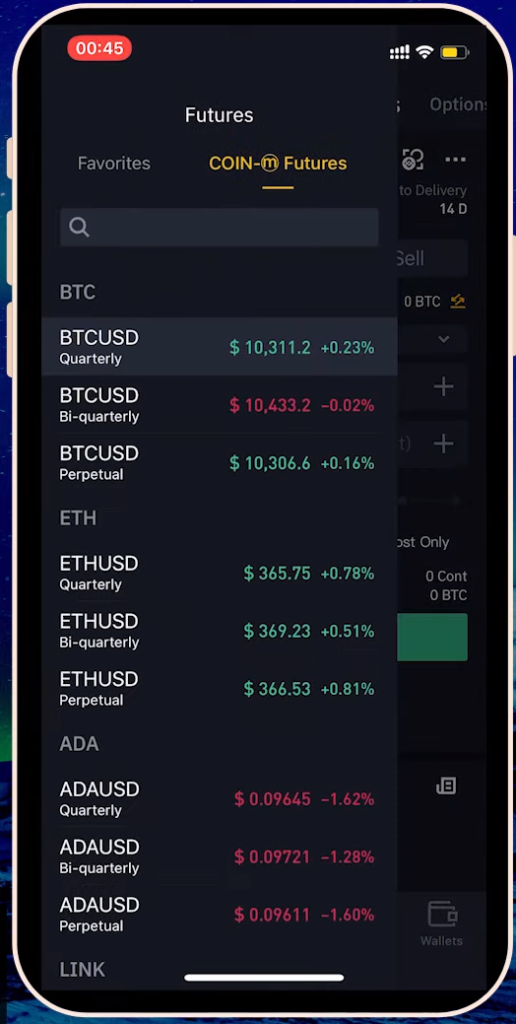

On the other side, Coin-margined futures contracts are termed and settled in underlying crypto assets, instead of holding USDT as collateral. These futures contracts offer a feature named contract multiplier which represents the value of contract. These futures contracts can also be perpetual contracts without any expiry date. But, they can be time delivery contracts too with some expiry dates. Usually these last quarterly or bi-quarterly.

Now the question is what are timely delivery futures contracts, and perpetual futures contracts?

In the below image, you can see three different types of BTC/USD coin-margined futures as quarterly, bi-quarterly, and perpetual.

Here the BTC/USD contracts which run quarterly and bi-quarterly are the timely delivery contracts, as they have particular expiry date.

On the other side, perpetual contracts are different from a regular futures contract. These contracts do not have an expiry date. So, when you long or short position, you are allowed to hold on to that date for an indefinite amount of time.

That is, of course, unless your position gets liquidated!

How can one make profits out of a perpetual contract?

These contracts come with a funding rate which ensures that the price of perpetual contract is staying as close as possible to underlying crypto asset.

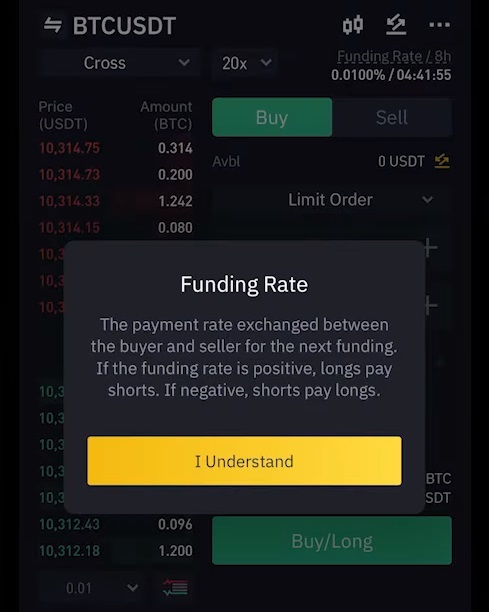

The below image shows when it’s time for next funding.

If the funding rate is positive, the long position holders pay the short. And, if the funding rate is negative, the shorts will pay for long.

How to trade on Binance Futures?

To place trades on Binance Futures:

- Firstly, the traders are required to select a crypto asset from the drop-down box under the main Menu. This will occupy the place order section of the platform with your chosen crypto coin.

- Now, it’s time to select the trade order size and include take profit or stop-sell level if required.

- Finally, click the Submit button, and the new trade will be visible in the open positions tab of your Binance Futures trading platform.

The traders can also use ‘Buy’ and ‘Sell’ buttons in the price chart panel for the quicker access. The specific trading parameters can also be chosen from the pop-up window which allows the traders to execute their trade.

Binance Futures specializes in trading of leveraged perpetual futures account. Once registered, the investors or traders can take both long and short positions on all the supported cryptocurrencies at the Binance platform.

Advantages of trading cryptocurrencies via Binance Futures

- Binance Futures lets the traders trade profitably in different market conditions

Yes! The traders can not only earn profits on the rising prices of crypto assets, but they can earn profits even if the price is falling. This feature enables the traders to navigate all types of market conditions.

- Hedge price risk

If you are a holder, you can use Binance futures to mitigate your risks. Say, you hold BTC. Going short on BTC futures will let you mitigate the risks if the prices are falling. In this case, you can choose short futures position which acts as a downside protection by locking in the USD value of your portfolio without the selling the crypto coin, i.e. BTC.

- Amplifies your trading gains with leverage

Leverage trading at Binance Futures allows you to open positions which are bigger than your capital. If you can open a position which is 20 times bigger than your capital, then you have 20x available for you.

Types of orders on Binance Futures

There are different order types available on Binance Futures that the traders can choose to trade smartly:

- Limit order- These orders are placed with a specific limit price. When the trader places a limit order, the trade would be executed only if the market price reaches the set limit price.

To set a limit order, the traders have to specify the prices at which they want to buy or sell any asset. Suppose the target price has been set at $10,000, and you have taken the quantity of 0.1 BTC. Therefore, as soon as the BTC price reaches the $10,000 mark, the order to buy/open position will be executed.

By placing limit orders, the traders can buy at lower price, and sell at higher price than the current market price of an asset

2. Market Order

These orders are considered as the most basic type of orders used in Binance Futures. They are essential to buy or sell any asset at the best current price. For market orders, traders are required to enter the order quantity.

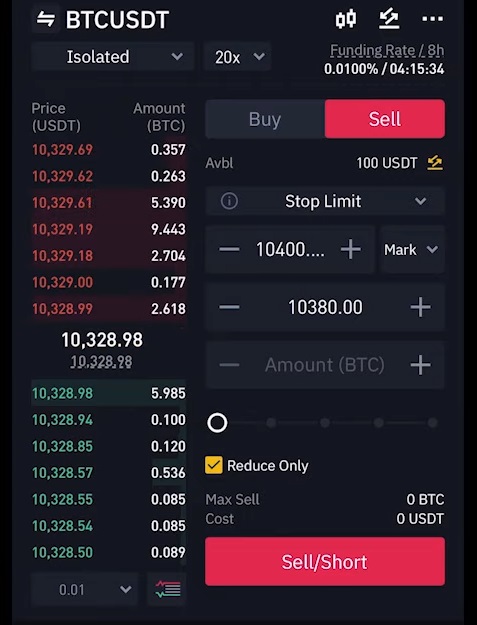

3. Stop Limit Order

When it comes to stop-limit orders, the stop price would be the price at which an order becomes a limit order. The limit price is the price of regular limit order. All this means that once your stop price is reached, the limit order would get placed.

In the below image, you can see a short position is opened. The stop price set is $10,400, and the limit price has been set at $10,380. Here the chances of limit order getting filled is higher once the stop price is reached.

4. Stop Market Order

This type of order functions in the same way as the stop limit order, with only difference being that as once the stop price is reached, the market order will be placed.

5.Trailing Stop Order

This is one of the complicated order types used in Binance Futures trading by the expert traders. This order type essentially makes sure that you gain profits while minimizing the probable losses which you might suffer on the currently open positions.

Whenever you open the long position, trailing stop will move up with a rise in price, but if the price moves down, trailing stop stops moving altogether. And, in the case, if the price moves a certain percentage, the sell order will be issued. And, all this is vice versa for a short position.

Mark price and last price

To avoid spiked and unnecessary liquidations during the high volatility, Binance Futures use last price and mark price.

Understanding last price is easier which means the last price that the contract was traded at. Last price is used to calculate Profit and Loss (PnL).

On the other side, Mark price is designed to prevent the price manipulations. It is calculated using the funding data and price data for multiple spot exchanges. It is used for liquidations and calculating the unrealized PnL.

Opening a short/long position in Binance Futures with Growlonix

To Open a Short position or Close a Long Position in Binance Futures following order types can be used:

- Limit Sell

- Market Sell

- Stop Loss (Where stop price is less than current price)

- Take profit (Where stop price is greater than current price)

- Trailing Stop Sell

- Take profit with Trailing exit

- OSO (Bracket Order) with any of the above order as Primary/Secondary Order

- OCO (One Cancel Other) with any of the above order as Primary/Secondary Order

To open a Long position or Close a Short Position in Binance Futures, following order types can be used:

- Limit Buy

- Market Buy

- Trailing Stop Buy

- Stop Buy – Price Greater than current price

- Stop Buy – Price Less than current price

- Stop Buy with Trailing Exit

- OSO (One Send Other) with any of the above order as Primary/Secondary Order

- OCO (One Cancel Other) with any of the above order as Primary/Secondary Order

Managing open positions

There are 4 tabs in the data table as shown above:

- Positions – View/ Manage Margin or Futures Open Positions. To immediately close any of the listed open positions click on Market to Close at Market price or Limit to close at given limit price.

- Open Orders – View/Manage Open Trades on Growlonix or Binance exchange. Some of the options are editing stop price in advance orders, cancelling open limit order, etc.

- Order History – View All past trades on Growlonix and Exchange account

- Triggers – View/Manage Email or Telegram Triggers set up while placing a trade.

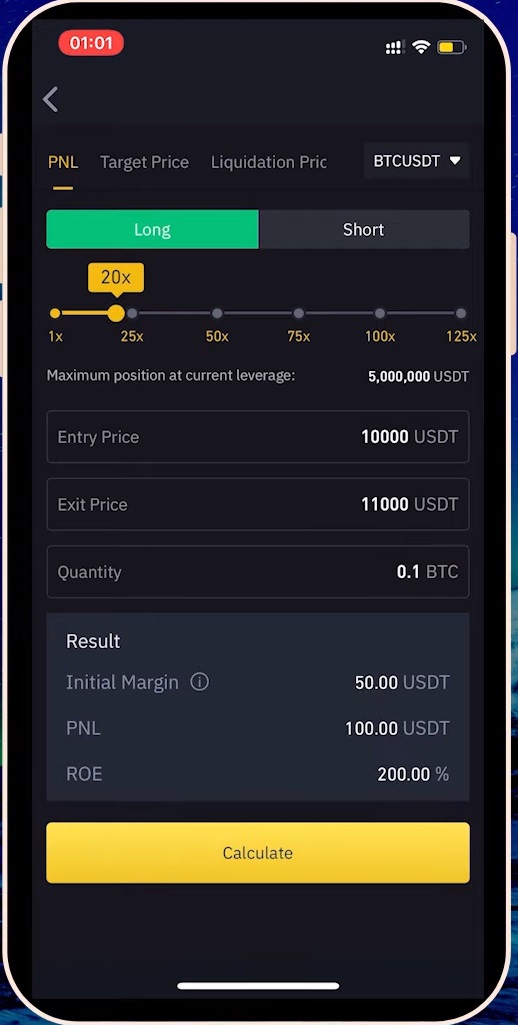

Binance Futures calculator

It is the necessity for all the expert and novice traders trading on Binance Futures. This calculator allows traders to open a long or short position, along with allowing them to adjust the leverage slider.

Binance Futures calculator comes with three tabs:

- PnL tab– This tab calculates the initial margin, PnL (Profit and loss), and ROE (Return on Equity) based on entering your entry and exit prices, leverage, and position tab.

- Target price tab– In this tab, you can enter your entry price, ROE, and leverage. This tab will calculate what your exit price would need to be for a particular return %.

- Liquidation price tab: in this tab, the traders can enter the entry price, intended quantity, and the wallet balance to calculate the approximate liquidation price.

Trading modes

To place trades on Binance Futures, you may select either isolated or cross margin trading mode.

- Isolated margin mode

This is the margin balance allocated to an individual position. Here, the allocated balance can be adjusted for the open positions. If your position gets auto-liquidated in this mode, you may lose only the isolated margin balance which you have allocated to the position instead of your entire margin balance.

Example:

Let’s say the trader A enters a position in BTC/USD trading worth $100 with 10x leverage, and sets the isolated margin position as $100. So, if the position here gets liquidated, the trader A would not lose more than $100 out of the margin balance.

- Cross margin mode

The other trading mode available for Binance futures trading is the cross margin trading mode. In this mode, all of your margin balance is shared over all of your current positions to avoid the risk of liquidation. Still, if liquidation happens in cross margin mode, you may end up losing your entire balance in the Binance Futures account, and the open positions.

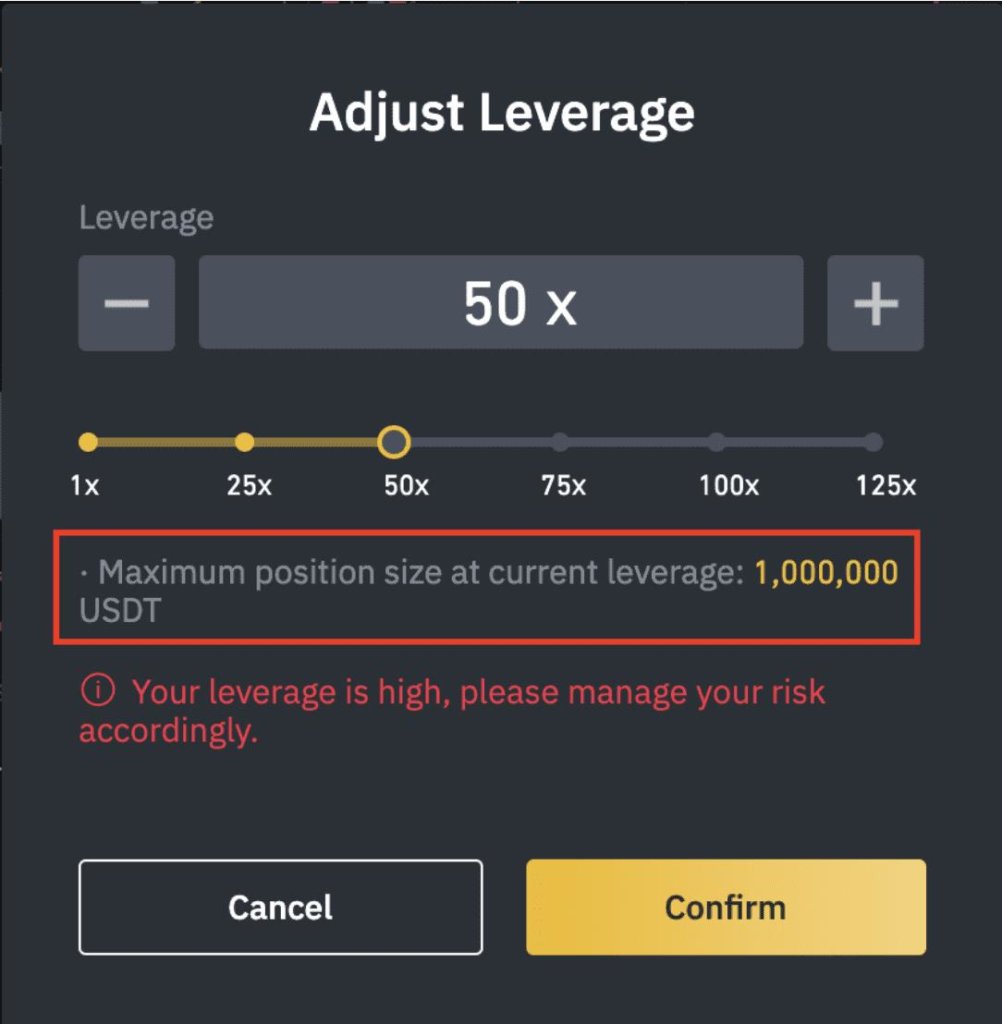

Adjusting leverage value

Leverage values are changed or updated in the context of a given Currency Pair.

When UI is loaded initially then it shows the users current leverage value in slider or in text input.

This value can be changed using Slider and Text input both as per users’ preference and updated value will get auto-synced on Both UI elements. Futures offer many advantages over traditional cryptocurrency trading.

With leverage trading on Futures; you can make significant profits with small market fluctuations and a small trading budget.

The leverage varies according to the crypto contract. Below are the popular ones:

- Bitcoin leverage of 125x

- Ethereum leverage of 75x

- XRP leverage of 75x

- Bitcoin Cash leverage of 75x

- Eos leverage of 75x

- Litecoin leverage of 75x

- TRON leverage of 75x

- Ethereum Classic leverage of 75x

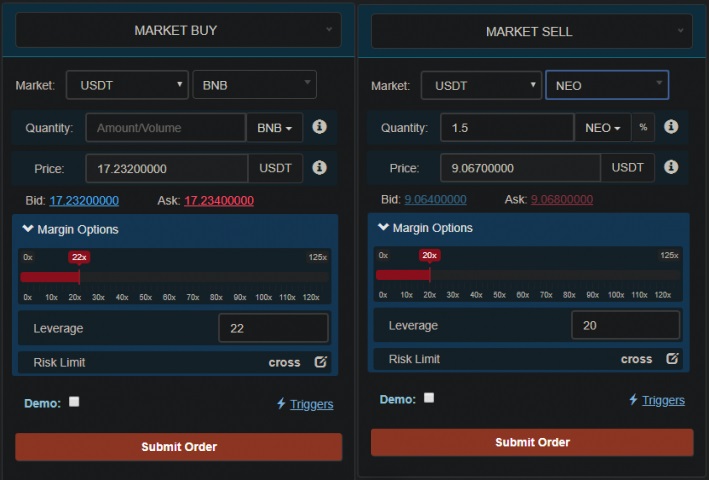

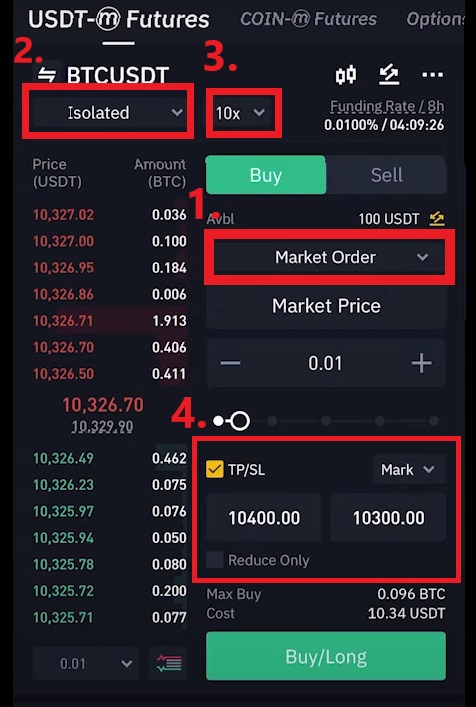

How to place an order on Binance Futures?

Let’s have a look at the order form, and the field which are required to be filled for a Futures order:

In the below image, there’s a BTC/USDT futures buy/long market order is placed. While filling the order, make sure to keep these four things in mind:

- Enter your preferred order type

- Select a trading mode

- Adjust the leverage

- And, finally, you will find take profit/stop loss checkbox