Table of Contents

Laddering (incrementally moving in and out of positions):

Instead of buying or selling at a single price, one would set incremental buy / sell limit orders up and down the order book, buying when the price goes down and selling when the price goes up.

This tutorial assumes you have a basic understanding of how a Take profit and a Stop loss order work.

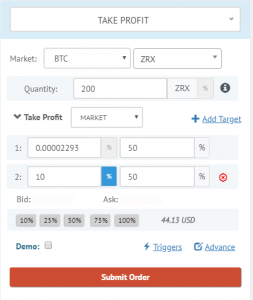

Take Profit with Multiple Price Targets:

-

-

-

-

-

-

- Click Add Target to add more profit targets. Click on Red cross icon on the right side of each target to delete it. (Maximum 10 Targets)

- Stop Price can be both absolute and relative. To set relative stop price click on the percentage button next to each individual stops. In the left hand side image it is visible that Target 1 is set at an absolute price of 0.00002293 and Target 2 is set at a relative price of 10% from the current price.

- Quantity will always be relative to main quantity. In the shown example main quantity is 200 ZRX. Target 1 is set to use 50% of 200 ZRX which is 100 ZRX. Target 2 will also use 50% which is 100 ZRX.

-

-

-

-

-

However a point to be noted here is that if main quantity is set to be relative quantity like 100% of total ZRX balance then quantity in each target will be determined accordingly at the time of execution. Eg. If main Quantity is 100% then Target 1 if set to 50% will use 50% of total balance at the time of execution and Target 2 if set to 50% will use 50% of the total balance remaining after the execution of Target 1.

Stop Loss & Stop Buy with multiple price targets:

In case of Stop Loss Everything will be same as it is in case of Take profit targets. Only difference is Targets will be hit if price is less than the stop price which is reverse of price tracking in Take profit order.

In case of Stop Buy, user can select the direction of price tracking and accordingly multiple stops will be triggered.

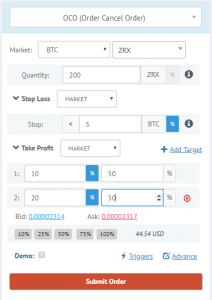

OCO with multiple profit targets:

Example – Coin: BTC/ZRX, Stop Loss: -5%, Take Profit 1: 10%, Take Profit 2: 20%

This can also be combined with Custom OSO to place buy + oco with multiple targets.

Order exit strategy:

Market : Once target stop price is hit a market buy/sell order will be placed on exchange.

Limit: Once target stop price is hit a limit buy/sell order with limit price same as Stop price will be placed on exchange.

Trailing: Once target stop price is hit a Trailing buy/sell order will start on Growlonix with defined offset.

Order History:

If you have any doubt or questions regarding setting multiple stop target in any of the given order types you can ask here in comment section or you can come for live chat on telegram group. https://t.me/Growlonix

Understood and well explain using ” TAKE PROFIT”