The primary objectives of forex traders are to reduce risk and to maximize profits. This way, they get to protect their hard-earned money and to earn more profits. To this end, the traders make use of several orders to instruct brokers. Notably, limit orders are significant in the traders’ efforts to achieve these objectives.

Traders can use limit orders in two ways. Firstly, the limit orders help traders to close already open positions. Secondly, the limit orders enable traders to buy or sell currency pairs at certain pre-selected prices. From the foregoing, the two types of limit orders are buy limit order and sell limit order. This article focuses on the latter.

What is a sell limit order?

A sell limit order is one that opens a sell position the moment the target currency pair hits the limit price. The limit price is the pre-selected price at which a sell limit order executes. Interestingly, this order may execute at the exact value or higher so long as it increases the chances of a higher profit. Usually, traders open a sell limit order if they strongly anticipate the value of the currency pair to fall.

In another sense, a sell limit order is the direct opposite of a buy limit order. Simply, the idea behind this type of order is that the limit price automatically triggers order execution.

How it works

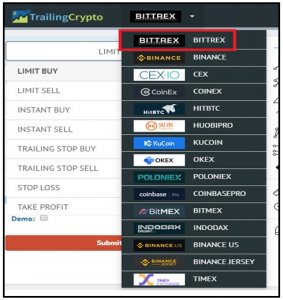

We learn best by doing, right? Let us consider this real life example. To see how sell limit works, you will to access a cryptocurrency trading exchange. Better still, you can use the Growlonix platform, which brings 15 crypto exchanges together. Once you create an account on Growlonix, you do not need to open another one with any exchange. Go on, create the account and (for illustration purposes) open Bittrex.

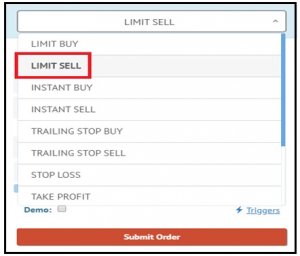

Next, access the trading window and select ‘LIMIT SELL’ from the drop down list.

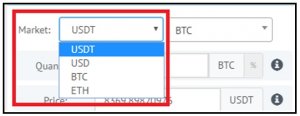

You will notice that the trade window now opens more sections where you will specify the terms of the trade. First, choose the market you would like to trade. On Bittrex, there are only four markets, that is, Tether (USDT), the US Dollar (USD), Bitcoin (BTC), and Ethereum (ETH).

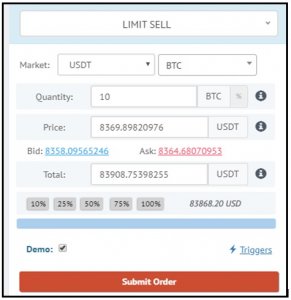

For our illustration, we shall choose USDT as the market and BTC as the base crypto. Further, we need to specify the amount of the base crypto that we are willing to trade, in our case that is 10 BTC.

As earlier noted, the limit price for a sell limit order must be higher than the market price. The current market value of BTCUSDT is 8364 (the Ask Price). Therefore, we have to set the sell limit price higher than that i.e. 8369.

Once you submit the order, it will remain pending until the Ask price of the BTCUSDT pair climbs and matches the limit price. Illustratively, the blue line in the screenshot below shows the limit price before order execution.

Once the value of the pair hits the limit price, the order will execute and you will now have an open position.