Cryptocurrency trading is maturing as an investment vehicle. However, it remains certain that the risk and volatility is never going to go away. Yet, the market continues to provide great opportunities for revenue generation. Fortuitously, there are tools that traders can utilize to mitigate the inherent risk in crypto trading. One such tool is trailing limit sell order.

What is trailing limit sell?

A trailing limit sell order is the kind that traders use to protect themselves from two things. One is to avoid losing money because of an order being fulfilled at an undesirable price. Two is to maximize profits because an order would be fulfilled at the best possible price. Trailing limit orders defer from trailing stop orders in that stop orders immediately convert to market orders when the asset touches the stop price. For the limit order, the order converts to market order at the set price or better.

Particularly, a trailing limit sell order is one where the limit sell order trails the market price of the cryptocurrency pair. Say, for example, that a trader places a trailing limit sell order for XBT/USDT. Then, the trader sets the trailing gap as 10%. Therefore, the limit sell order will always be 10% away from the market price of XBT/USDT. If the pair moves from 9,584 to 9,400, the trailing amount recalibrates. This way, the distance between the market price of the pair and the limit sell order remains 10%. If the pair increases in value, however, the limit sell price does not go down.

Demonstrating how tool works

Growlonix is a great platform from which you can trade cryptocurrency. This platform brings together all the great crypto trading exchanges such that users can access them all with just one account. For that reason, we will use this platform to demonstrate how trailing limit sell orders work. On Growlonix, a trailing limit sell order works in a similar manner as the trailing stop sell order. Therefore, we shall rely on this order to illustrate the point.

Step 1

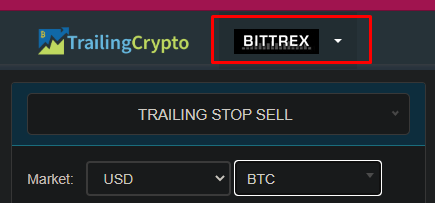

On Growlonix, the first thing is to log in and choose a desirable exchange. In this case, we are using Bittrex.

Step 2

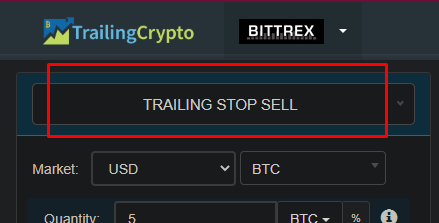

On the orders window, select “Trailing Stop Sell”.

Note that, on some exchanges, the difference between a trailing stop sell order and a trailing limit sell order is subtle. That means that a trader is most likely to end up with the same result no matter the choice between the two. However, the difference in result may get big if the market is highly volatile.

Step 3

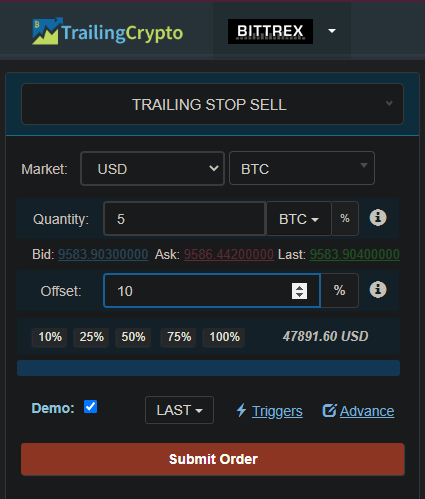

Once you have specified the order type, you can go ahead and enter the desired parameters. In our example, we chose the market as the US dollar (USD) trading against Bitcoin (BTC). In addition, we specified the quantity of the order as 5 BTC. For the trailing amount (otherwise known as offset on Growlonix), we chose 10%. All boxes filled, click “Submit Order”.

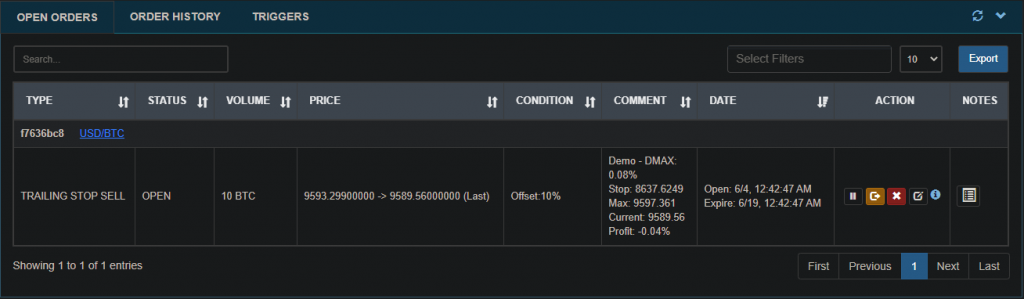

A submitted order will appear on a window down below like this one here:

Conclusion

A trailing limit sell order is important because it allows traders to make the most in a bear market. The target price always remains above the market price. As the market price lowers, the target price trails downwards. The recalibration continues until when the market price begins to rise when the order converts to a market order upon the target price touching the market price.